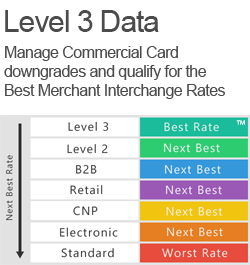

Level 3 Interchange Rates & Requirements

Pass Level 3 data to eliminate non-qualified surcharges

For commercial card types that can qualify for Level 3 Interchange, address verification, invoice number, tax amount, and line item detail fields like product code, item description, item quantity, unit of measure and extended item amount must be submitted with the standard sales information. In addition, specific Interchange compliance requirements must be managed and include merchant category restrictions, authorization, clearing, timeliness and registration.

MasterCard and Visa are continuously making adjustments to both their Interchange rate and qualification requirements. Currently Visa and MasterCard both require submitting a tax amount greater than zero to qualify for Level 2 / Data Rate 2 Interchange rates but for tax exempt transactions Level 3 / Data Rate 3 Interchange rates are available provided data and other processing requirements are met. The difference between the best and worst rates equal $12 in savings per $1,000 in sales. However, the difference between the best and next best rates across the entire Interchange spectrum continues to favor those merchants processing at Level 3. And these savings continue to grow.

Leading indicators that your processing costs are too high

- You have the same rates for both MasterCard and Visa

- You have only one Qualified Rate

- You pay Mid & Non-Qualified Rates

- You use a terminal for processing P-card transactions

- You use a “B2Consumer” virtual terminal or payment gateway

Contact us for a Level 3 Interchange quote detailing Visa, MasterCard and Discover commercial card rates, qualification requirements and next best rates.

Qualifying for incentive Level 3 processing rates while eliminating Non-Qualified surcharge fees may reduce your processing expenses by an average of 15% to 20% and in some cases much more!

Visa & MasterCard Qualification Requirements

Data elements must be submitted unchanged from authorization through settlement. If any values are changed the transaction is reclassified to a downgraded Interchange level. Only one authorization and one clearing record per transaction are allowed, unless expressly indicated. Authorization and Settle must match, unless expressly indicated. Below is an example of some of the data elements at each level:

Level 1 Data:

- Account Number (also referred to as Primary Account Number or PAN)

- Authorized Amount (Original Amount)

- Merchant Category Code (MCC)

- POS Entry Mode

- Authorization Code

- Authorization Response Code

- Authorization Currency Code

- Authorization Characteristic Indicator (ACI)

- Transaction Identifier (Tran ID)

- Validation Code Field

- Market-Specific Authorization Data (MSAD) Indicator

Level 2 data:

- Tax Amount

- AVS

- Invoice #

Level 3 data:

- Product Code

- Item Description

- Item Quantity

- Item Unit of Measure

- Extended Item Amount